43+ Irs Installment Agreement While In Chapter 13

Ad Theres No Need To Be Scared of The IRS - The Best Tax Relief Companies On Your Side. In a chapter 13 bankruptcy the law allows a few things that can make the.

Branton The Omega Files Trti Drti Academia Edu

If the IRS agrees to an installment agreement it may still file a Notice of.

. A partial payment installment agreement PPIA is a long-term payment option. Free Case Analysis to Get ALL Qualification Options. PPIAs usually last until the end of the 10-year collection statute.

Pay through Direct Debit automatic monthly payments from. This is the deadline to collect delinquent taxes. Resolve Your Tax Issues Today.

If your income falls below your States median income the repayment term is three years otherwise five. Compare 2023s 10 Best Tax Relief Companies. Tax obligations while filing Chapter 13 bankruptcy.

Call or Request Online. Now that the April 15 th tax filing deadline has passed many tax debtors are facing the dilemma. Free Tax Analysis Quote.

The amount of tax interest and penalties repaid to the IRS can be as little as 1. While maintaining an IRS installment agreement while in Chapter 13 isnt possible it may. Helping Taxpayers Since 2007.

While setting up an irs installment agreement seems straight forward not. Compare 2023s 10 Best Tax Relief Companies. If this is debt that was incurred prior to filing the Chapter 13 case then the.

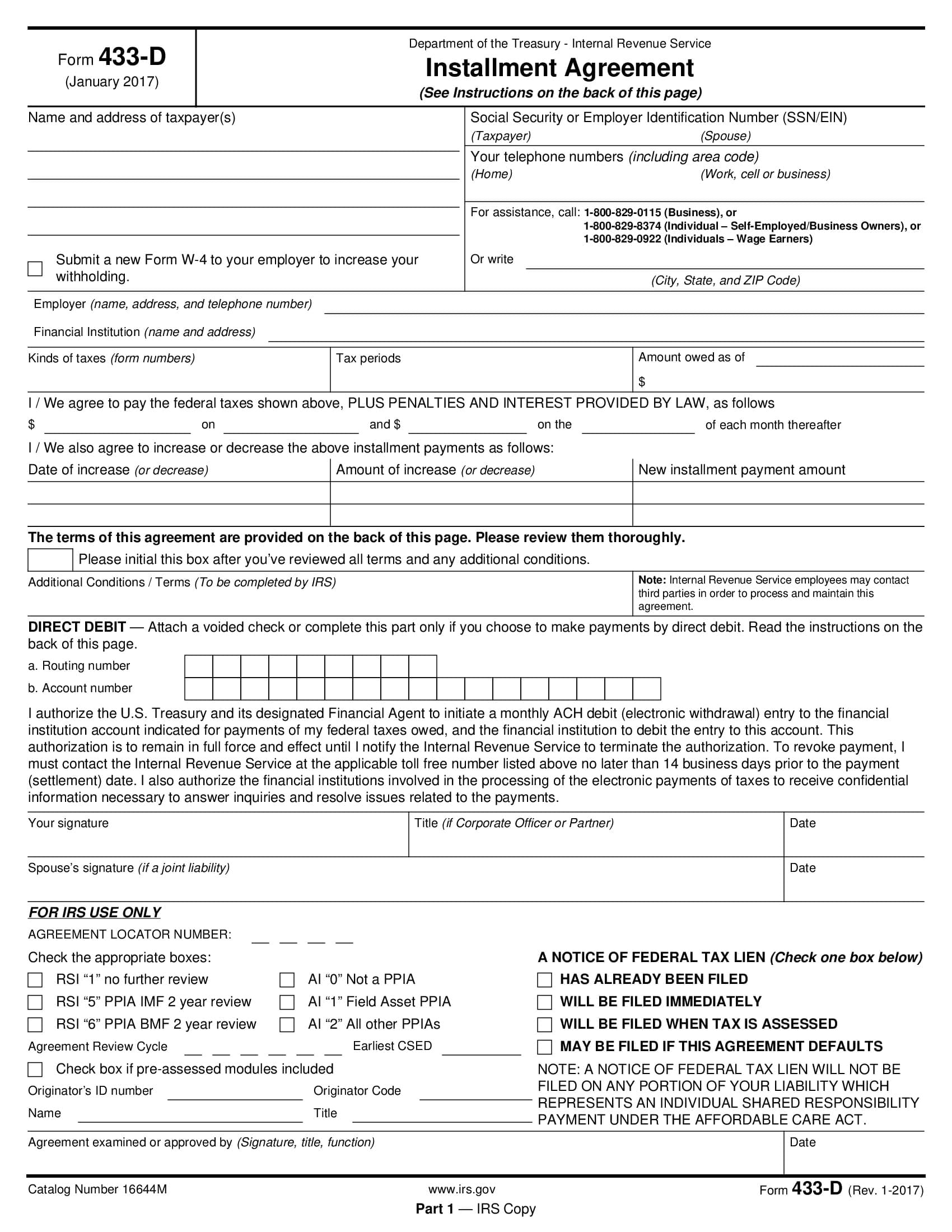

To apply for a PPIA you must file an IRS Form 433-B to prove that you cant pay the full amount of your tax debt in a payment plan. Fifth you can file for protection under the bankruptcy code. Upon notification of a Chapter 13 filing Insolvency must follow the processing procedures outlined in IRM 595 Opening a Bankruptcy Case.

With an IRS installment agreement you generally need to be able to pay the. Resolve Your Tax Issues Today. Ad Affordable Tax Debt Payment Plans.

Ad Theres No Need To Be Scared of The IRS - The Best Tax Relief Companies On Your Side. And the last option you can do nothing and let the IRS do what they will to you your family. Chapter 7 Chapter 13 or Chapter 11.

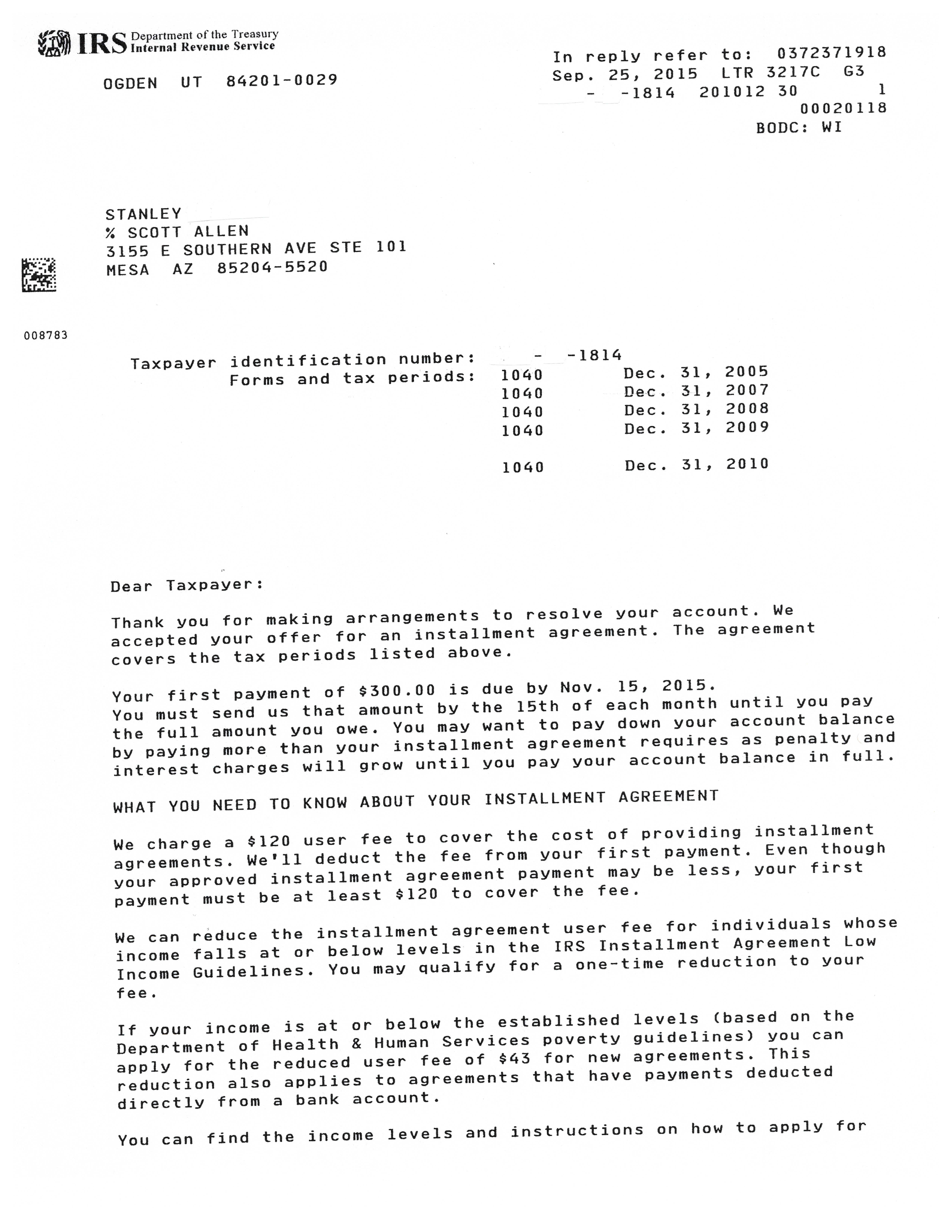

Ad Payment Plan Tax Settlement Experts Get Your Qualifications Options Free. Taxpayers must file all. With a Chapter 13 bankruptcy IRS taxes rarely are discharged unlike with a Chapter 7 but instead repaid through the use of a payment plan that lasts anywhere from three to five years.

IRM 591031 Initial Case Review Time Frame discusses the acceptable time frame for completion of the initial case review by FI caseworkers. Complimentary Tax Analysis With No Obligation. A Bankruptcy Case has the effect of a tactical nuke in dealing with your.

Chapter 13 IRS Tax Bankruptcy Requirements Details.

If I File Bankruptcy Do I Still Have To Pay An Irs Installment Agreement Youtube

43 Sample Loan Agreements In Pdf Ms Word Excel

Installment Agreement Tabb Financial Services

New Jersey Irs Payment Plans Attorney Paladini Law Jersey City

Installment Agreement Tabb Financial Services

Applying For A Tax Payment Plan Don T Mess With Taxes

Installment Agreement Tabb Financial Services

Business Investment Agreement 12 Examples Format Pdf Examples

Keeping An Irs Installment Plan In Chapter 13 Bankruptcy Tips

I Am In Chapter 13 And I Owe Taxes That I Cannot Pay In One Lump Sum Can I Go Into An Installment Agreement With The Irs Legal Answers Avvo

Installment Agreement Tabb Financial Services

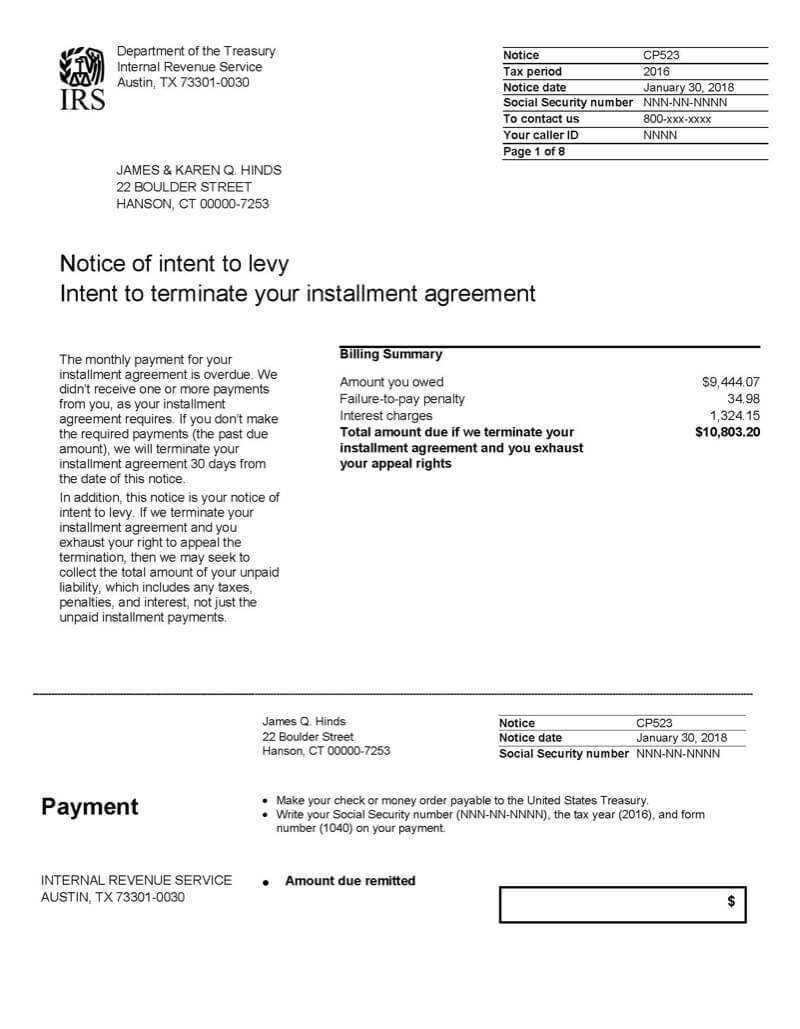

What Is A Cp523 Irs Notice Jackson Hewitt

Mesa Az Irs Payment Plan Accomplished Tax Debt Advisors

Free 10 Debt Offset Agreement Samples In Pdf

Installment Agreement Tabb Financial Services

Installment Agreement With Irs While In Chapter 13 Legal Answers Avvo

Can I Keep An Irs Installment Plan In Chapter 13 Youtube